Tag: DepthPR

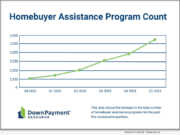

Down Payment Resource Q1 2024 HPI Report finds the U.S. homebuyer assistance program count increased by 204 year-over-year

eNewsChannels NEWS: -- Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q1 2024 Homeownership Program Index (HPI) report. In a quarter where year-over-year (YoY) home prices jumped 6%, the YoY national down payment assistance count increased by 204, the largest annual jump since DPR began reporting on this data in Q3 2020.

Total Expert and Dark Matter partner to boost lender revenue through best-in-class mortgage automation and customer engagement

eNewsChannels NEWS: -- Dark Matter Technologies (Dark Matter) today announced a new strategic partnership with Total Expert, the customer engagement platform purpose-built for modern financial institutions. A forthcoming bi-directional integration between Total Expert and the Empower® loan origination system (LOS) from Dark Matter will empower mortgage lenders to generate more leads, improve sales productivity and close more loans by intelligently automating and personalizing the homebuyer journey.

Mortgage Finance Expert Kurt Raymond, CMB joins Informative Research as Senior Vice President

eNewsChannels NEWS: -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced it has expanded its team to add mortgage industry veteran Kurt Raymond, CMB as Senior Vice President and Borrower Journey Engineer. The move reflects Informative Research's commitment to helping lenders streamline origination costs and enhance the borrower experience.

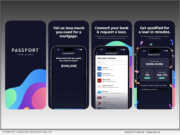

FormFree upgrades Passport Wallet App with optimized UI, VantageScore integration, streamlined asset validation

eNewsChannels NEWS: -- FormFree®, a leader in financial technology since 2007, today announced significant enhancements to Passport Wallet®, an innovative app that transforms how everyday people access loans. Available now in the Apple App Store and Google Play, the latest version of Passport Wallet is designed to make it easier than ever for consumers to understand their ability to pay and match with lenders.

Dark Matter to support Bay Area CU’s mortgage team by boosting productivity while enhancing the member experience

eNewsChannels NEWS: -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the implementation of the Empower® loan origination system (LOS) by Patelco Credit Union (Patelco), a Bay Area-based credit union dedicated to the financial wellness of its team, members and communities.

Floify Direct integration with Truv enables lenders to support an enhanced borrower application-verification experience at lower cost-point per loan

eNewsChannels NEWS: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced an integration with Truv, a consumer-permissioned data platform. The integration enables borrowers to electronically verify their income and employment as they apply for a mortgage loan.

Michael Housch of Dark Matter Technologies named one of North America’s preeminent CISOs

eNewsChannels NEWS: -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced that its Chief Risk and Information Security Officer Michael Housch has been named to CISOs Connect(tm)'s 2024 list of the top 100 CISOs in North America. Housch was recognized for his role as Dark Matter's chief risk and information security officer as well as for his contributions to the cybersecurity community at large.

Q1 2024 Homebuyer Intelligence Report Data Shows Increase in Home Buying Activity and Fees Collected by Fee Chaser

eNewsChannels NEWS: -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the latest release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process during the first quarter (Q1) of 2024.

Click n’ Close Expands its DPA Mortgage Product Suite – Includes Option for Shared Appreciation

eNewsChannels NEWS: -- Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, announced it has expanded its suite of down payment assistance (DPA) loan products to include a shared appreciation option to help address the affordability challenges facing homebuyers.

Aaron Belovsky joins Mortgage Subservicer Dovenmuehle as Chief Data Officer

eNewsChannels NEWS: -- Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading residential mortgage subservicer, announced today that it has hired Aaron Belovsky as Chief Data Officer (CDO). In this role, Belovsky will lead data governance, data engineering and machine learning strategies.

Enhanced Floify integration with Total Expert enables lenders to support a lending experience that reflects the acquired knowledge of a nurtured...

eNewsChannels NEWS: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced an enhanced integration with customer engagement platform Total Expert. This collaboration enables loan originators to effortlessly send pre-populated loan applications to borrowers, leveraging the existing data within Total Expert. This feature is designed to streamline the loan origination process for lenders and enhance the application experience for borrowers by reducing redundant data entry.

Optimal Blue Promotes Rick Allen to Chief Operating Officer

eNewsChannels NEWS: -- Optimal Blue today announced that it has elevated Rick Allen to chief operating officer (COO). Most recently serving as Optimal Blue's chief administrative officer, Allen brings more than 35 years of experience in the housing industry to his senior leadership role. Throughout his tenure at Optimal Blue, Allen has played an integral role in the enhancement and delivery of products to add exceptional value to the company's clients.

Heartland MLS implements Down Payment Resource to raise homebuyer awareness about down payment assistance programs in Greater Kansas City area

eNewsChannels NEWS: -- Down Payment Resource (DPR), the housing industry's leading technology for connecting homebuyers with homebuyer assistance programs, today announced that Heartland Multiple Listing Service (MLS) has implemented its tools to notify real estate agents when homebuyers may be eligible for down payment assistance. According to a DPR analysis, 87% of Heartland MLS's listings are eligible for one or more homebuyer assistance programs.

Optimal Blue Issues March 2024 Originations Market Monitor: Average Homebuyer Credit Score Hits the Highest Mark in Years

eNewsChannels NEWS: -- Today, Optimal Blue released its March 2024 Originations Market Monitor report, which reveals the average homebuyer credit score has reached 737 - an all-time high since the company began tracking this data in January 2018. Despite the potential buyer pool being somewhat limited to borrowers with higher credit, rate lock volume showed steady month-over-month growth of 17% in March as the spring buying season got underway.

ACES Quality Management (ACES) Q3 2023 Mortgage QC Trends Report Finds Critical Defect Rate Declines for Fourth Consecutive Quarter

eNewsChannels NEWS: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the third quarter (Q3) of 2023. The latest report analyzes post-closing quality control data derived from ACES Quality Management & Control® software.

Mobility Market Intelligence (MMI) Welcomes Ryan Minard as Senior Sales Engineer

eNewsChannels NEWS: -- Mobility Market Intelligence (MMI), a leader in data intelligence and market insight tools for the mortgage and real estate industries, announced today that Ryan Minard is its newest senior sales engineer. With more than 17 years of collective experience in mortgage and creative marketing, Minard's expertise lies in applying an empathetic approach to address mortgage lenders' marketing and business challenges.

To Improve Mortgage Verification Services, Informative Research Announces Manual VOI Integration with Veri-Tax

eNewsChannels NEWS: -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced the integration of Veri-Tax, the market leader in delivering the industry's fastest verifications, into its proprietary Verification Platform. The integration merges Informative Research's platform with Veri-Tax's verification services so lenders can access advanced validation tools that elevate the accuracy and reliability of borrower information.

Sofia Rossato of FLOIFY named as advisor to the Broker Action Coalition (BAC) board of directors

eNewsChannels NEWS: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced that President and General Manager Sofia Rossato has been named as a board advisor to the newly formed board of Broker Action Coalition (BAC), a nonprofit organization created in 2022 to advocate for legislative reform and educational advancement within the independent mortgage broker community.

Moody’s affirms Dovenmuehle Mortgage’s overall rating as an ‘above average’ residential mortgage loan servicer

eNewsChannels NEWS: -- Dovenmuehle Mortgage, Inc. (Dovenmuehle), a leading residential mortgage subservicer, announced today that Moody's Investors Service ("Moody's") has affirmed its servicer quality (SQ) assessment as a servicer of prime residential mortgage loans at SQ2-. Moody's assessment underscores Dovenmuehle's exceptional capabilities across various key areas of mortgage servicing.

Bill Warden of Dark Matter Technologies recognized among The Top 25 CFOs of Jacksonville, Florida for 2024

eNewsChannels NEWS: -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced that its Chief Financial Officer (CFO) Bill Warden has been recognized on the 2024 list of The Top 25 CFOs of Jacksonville. The Top CFOs awards program honors highly respected CFOs who have driven growth in their companies and the city's business community, solidifying Jacksonville as an economic giant.

Press Release: PROGRESS in Lending recognizes Argyle as a leader in mortgage industry innovation

eNewsChannels NEWS: -- Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, is a 2024 recipient of the PROGRESS in Lending Association's 2024 Innovations Award honoring the most innovative companies in the U.S. mortgage industry. Argyle was recognized for its revolutionary approach to verification of income and employment (VOIE) that delivers meaningful cost savings for lenders and a superior experience for customers.

Click n’ Close adds correspondent loan program to TMC’s Preferred Partner network

eNewsChannels NEWS: -- Click n' Close, a multi-state mortgage lender, today announced its Preferred Partner status with The Mortgage Collaborative (TMC), a leader in mortgage cooperatives dedicated to providing its members with cutting-edge technology and expert mortgage banking resources.

Former FHFA Chief Fintech Officer Jason Cave joins Argyle board of advisors

eNewsChannels NEWS: -- Argyle, a platform providing automated income and employment verifications for some of the largest lenders in the United States, today announced the addition of Jason Cave, former chief fintech officer and deputy director of the Federal Housing Finance Agency's Division of Conservatorship Oversight and Readiness, to its board of advisors.

Press Release: Fast Company recognizes Argyle among the Most Innovative Companies of 2024

eNewsChannels NEWS: -- Argyle, the leading provider of direct-source income and employment data, has been named one of 2024's Most Innovative Companies by Fast Company. After evaluating a field of thousands of organizations worldwide, Fast Company editors, reporters and contributors ranked Argyle #5 globally for innovation in the Personal Finance category.

Sara Holtz, formerly of ICE Mortgage Technology, Joins Optimal Blue as Chief Marketing Officer

eNewsChannels NEWS: -- Optimal Blue announced today that it has appointed Sara Holtz as chief marketing officer. As a seasoned marketing and communications leader, Holtz brings more than 20 years of career experience, including a decade of driving change in the mortgage industry. As chief marketing officer, Holtz will drive unified marketing and communications strategies to advance Optimal Blue's business priorities and further extend the company's influence.