Tag: FinTech

Ryan Kaufman of Informative Research Named to HousingWire 2024 Rising Star list

eNewsChannels NEWS: -- Informative Research, a leading technology platform that delivers data-driven solutions to the lending community, announced today that Ryan Kaufman, IT Manager - Integrations, has been selected by HousingWire magazine for its annual Rising Stars award.

Secured Signing Brings Streamlined Online Notarization to North Dakota Notaries

eNewsChannels NEWS: -- Imagine notarizing documents from the comfort of your couch, or while catching up on emails at your home office. For North Dakota notaries and their clients, that future is now a reality. Secured Signing, a leading innovator in Remote Online Notarization (RON) technology, is proud to announce its RON platform meets and exceeds the requirements as an official RON platform in the state.

Agile Trading Technologies Introduces Competitive Electronic Bidding on Fourth Month TBA Mortgage-Backed Securities

eNewsChannels NEWS: -- Agile, a groundbreaking fintech bringing mortgage lenders and broker-dealers onto a single electronic platform, announced today the launch of electronic bidding for the fourth month in the To-Be-Announced mortgage-backed securities (TBA) market. This marks a significant leap forward in the trading landscape of off-screen securities.

Argyle recognized with ‘Silver Stevie’ as a Financial Services Company of the Year in the 2024 American Business Awards

eNewsChannels NEWS: -- Argyle, the leading provider of direct-source income and employment data, is a winner of the 22nd annual American Business Awards®. The company received a Silver Stevie® in the mid-sized Financial Services Company of the Year category in recognition of its innovative approach to automating income a

Total Expert and Dark Matter partner to boost lender revenue through best-in-class mortgage automation and customer engagement

eNewsChannels NEWS: -- Dark Matter Technologies (Dark Matter) today announced a new strategic partnership with Total Expert, the customer engagement platform purpose-built for modern financial institutions. A forthcoming bi-directional integration between Total Expert and the Empower® loan origination system (LOS) from Dark Matter will empower mortgage lenders to generate more leads, improve sales productivity and close more loans by intelligently automating and personalizing the homebuyer journey.

MCT Launches Complete Best Execution, with Fully Integrated Retain vs. Release MSR Decisioning

eNewsChannels NEWS: -- Mortgage Capital Trading, Inc. (MCT®), the de facto leader in innovative mortgage capital markets technology, proudly introduces a game-changing advancement: a Best Ex for Released and Retained all in one platform!

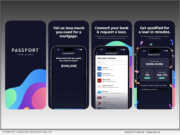

FormFree upgrades Passport Wallet App with optimized UI, VantageScore integration, streamlined asset validation

eNewsChannels NEWS: -- FormFree®, a leader in financial technology since 2007, today announced significant enhancements to Passport Wallet®, an innovative app that transforms how everyday people access loans. Available now in the Apple App Store and Google Play, the latest version of Passport Wallet is designed to make it easier than ever for consumers to understand their ability to pay and match with lenders.

Dark Matter to support Bay Area CU’s mortgage team by boosting productivity while enhancing the member experience

eNewsChannels NEWS: -- Dark Matter Technologies (Dark Matter), an innovative new leader in mortgage technology backed by time-tested loan origination software and leadership, today announced the implementation of the Empower® loan origination system (LOS) by Patelco Credit Union (Patelco), a Bay Area-based credit union dedicated to the financial wellness of its team, members and communities.

Floify Direct integration with Truv enables lenders to support an enhanced borrower application-verification experience at lower cost-point per loan

eNewsChannels NEWS: -- Floify, the mortgage industry's leading point-of-sale (POS) solution, today announced an integration with Truv, a consumer-permissioned data platform. The integration enables borrowers to electronically verify their income and employment as they apply for a mortgage loan.

Click n’ Close Expands its DPA Mortgage Product Suite – Includes Option for Shared Appreciation

eNewsChannels NEWS: -- Click n' Close, a multi-state mortgage lender serving consumers and mortgage originators through its wholesale and correspondent channels, announced it has expanded its suite of down payment assistance (DPA) loan products to include a shared appreciation option to help address the affordability challenges facing homebuyers.