Tag: Mortgage

Ascribe Appoints Craig Bennett as CEO

eNewsChannels NEWS: -- Ascribe, a leading provider of real estate valuation and inspection services, has appointed Craig Bennett as chief executive officer to lead the company in its next phase of growth.Bennett brings nearly 15 years of senior-level experience in financial services to his post which includes 5 years at StoicLane, Ascribe's parent company.

The Mortgage Collaborative Appoints Rich Swerbinsky as Strategic Advisor to CEO

eNewsChannels NEWS: -- The Mortgage Collaborative (TMC), the nation's only independent, wholly-owned mortgage lending cooperative, today announced the appointment of Rich Swerbinsky as Strategic Advisor to the CEO & President and Heidi Belnay as Senior Advisor for Business Development. These strategic additions to the leadership team position TMC for accelerated growth and continued industry impact in 2026 and beyond.

TMC to host inaugural 2026 ACT Technology Summit focused on mortgage technology and AI

eNewsChannels NEWS: -- The Mortgage Collaborative (TMC), the nation's leading independent cooperative network for mortgage lenders, today announced it will host the inaugural ACT Technology Summit, short for Accelerator and Collaborative Transformation, a two-day standalone mortgage technology competition and showcase Aug. 12-13 at The Highlands Hotel in Dallas.

LenderLogix expands LiteSpeed POS with native eSignature for loan teams and borrowers

eNewsChannels NEWS: -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced LiteSpeed eSign, a fully native eSignature experience built into the LiteSpeed point of sale (POS) platform. Serving both sides of the mortgage process, LiteSpeed eSign enables lenders to tag and request documents for electronic signatures directly in Encompass without the need to switch platforms.

The Mortgage Collaborative (TMC) launches new individual subscription membership option

eNewsChannels NEWS: -- The Mortgage Collaborative (TMC), the nation's leading independent cooperative network for mortgage lenders, today announced the launch of an individual subscription membership option that expands access to its network for mortgage professionals seeking connection, insight and peer engagement outside a traditional lender membership.

ACES Quality Management Announces Availability of ACES DATABRIDGE for Enterprise Data Portability

eNewsChannels NEWS: -- ACES Quality Management#xae; (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced the general availability of its latest innovation, ACES DATABRIDGE, which makes ACES customer data fully portable.

FirstClose Integrates Stewart Home Equity Solutions into its OMS, Streamlining Lender Workflows

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, announced today a new partnership with Stewart Lender Services, a division of Stewart Information Services Corporation (NYSE: STC), that enhances FirstClose's Order Management System (OMS) with expanded home equity fulfillment capabilities.

Optimal Blue finance report 2025: Lock volume posts strongest November since 2021

eNewsChannels NEWS: -- Optimal Blue today released its November 2025 Market Advantage mortgage data report, which found that total mortgage rate-lock activity declined with normal late fall seasonality, yet still marked the strongest November in four years. Total lock volume fell 25% month over month (MoM) from October but remained up 17% year over year (YoY), buoyed by historically strong refinance demand and mortgage rates holding near 6%.

Optimal Blue adds Lanny Rogers as chief financial officer and Jeremy Moreno chief revenue officer

eNewsChannels NEWS: -- Optimal Blue today announced the promotion of Lanny Rogers III, CPA, to chief financial officer (CFO) and Jeremy Moreno to chief revenue officer (CRO). Their combined experience and long track records of leadership position the company to advance its next stage of growth and client success with a dedicated financial strategy function and strengthened revenue oversight.

Sriranjini Prabhakara of Informative Research Named to 2025 National Mortgage Professional 40 Under 40 List

eNewsChannels NEWS: -- Informative Research (IR), a leading technology provider of data-driven credit and verification solutions for the lending industry, today announced that Software Developer Sriranjini "Sri" Prabhakara has been named to National Mortgage Professional Magazine's 2025 40 Under 40 list. The annual recognition highlights emerging professionals whose work is helping shape the future of the mortgage sector.

FirstClose appoints Alex Sirpis as VP of Sales

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced the appointment of Alex Sirpis as vice president of sales. In this role, Sirpis will lead the company's sales organization, refine the go-to-market strategy and drive revenue growth as FirstClose continues expanding its presence with mortgage and home equity lenders across the country.

Rivermark Community Credit Union Expands Subservicing Relationship with Dovenmuehle Mortgage, Inc.

eNewsChannels NEWS: -- Dovenmuehle Mortgage, Inc. (DMI), a leading mortgage subservicing company, announced today that Rivermark Community Credit Union has expanded its partnership with DMI. Under this expanded relationship, Dovenmuehle will provide subservicing for Rivermark's growing portfolio of mortgage loans, supporting the credit union's expanding membership base and ensuring an exceptional servicing experience for members.

The Big Picture Webcast’s final lineup of 2025 features mortgage power players in conversation on the future of the industry

eNewsChannels NEWS: -- Top mortgage industry webcast The Big Picture, broadcast live every Thursday at 3 p.m. ET, announced a December lineup of trailblazing figures in loan origination technology, real estate and housing finance advocacy. Co-hosted by mortgage business consultant and executive coach Rich Swerbinsky and capital markets authority Rob Chrisman.

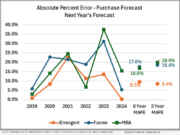

New analysis shows iEmergent’s mortgage origination projections outperforming other publicly available forecasts over a six-year period

eNewsChannels NEWS: -- iEmergent, a forecasting and advisory services firm for the financial services, mortgage and real estate industries, released a new analysis validating that its U.S. purchase mortgage origination forecasts continue to lead the industry in accuracy, outperforming other publicly available forecasts such as those published by Fannie Mae and the Mortgage Bankers Association (MBA) over the last six years.

FirstClose Names Adam Nicholson as Director of Professional Services

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced the appointment of Adam Nicholson as director of professional services. Nicholson will lead the company's implementation operations, including project delivery, process optimization and cross-functional coordination to enhance the customer experience.

DocMagic enhances its Total eClose platform with new IPEN capability for broader digital closing

eNewsChannels NEWS: -- DocMagic, Inc. announced today the availability of its in-person electronic notarization (IPEN) capability, extending the company's Total eClose™ platform to support more closing scenarios and borrower preferences across the country. IPEN offers lenders, settlement agents, notaries and borrowers an additional digital option for situations where remote online notarization (RON) is not jurisdictionally permitted or simply not the preferred experience.

ACES 2025/Q2 Mortgage QC Industry Trends Report shows modest rise in critical defect rate as refinance complexity tests loan quality

eNewsChannels NEWS: -- ACES Quality Management® (ACES), the leading provider of enterprise quality management and control software for the financial services industry, today announced the release of its quarterly ACES Mortgage QC Industry Trends Report covering the second quarter (Q2) of 2025. The report analyzes post-closing quality control data derived from the ACES Quality Management & Control® software.

MMI Honored with 2025 AI Pioneer Award for Innovative Use of Artificial Intelligence in Mortgage Tech

eNewsChannels NEWS: -- Mobility Market Intelligence (MMI), the leader in mortgage technology, has been recognized with the 2025 AI Pioneer Award by PROGRESS in Lending Association for leveraging artificial intelligence like ChatMMI cross its platform to deliver to deliver real, measurable outcomes for lenders-from opportunity discovery and timely outreach to borrower retention and lifetime loyalty.

Rice Park Capital Acquires Rosegate Mortgage, Enhancing End-to-End Mortgage Capabilities and MSR Investment Platform

eNewsChannels NEWS: -- Rice Park Capital Management LP ("Rice Park"), a Minneapolis-based private investment firm specializing in mortgage servicing rights (MSRs), announced today that it has acquired Rosegate Mortgage, LLC ("Rosegate Mortgage"), NMLS #2020757, a retail and consumer-direct mortgage lender headquartered in Charlotte, NC.

The Mortgage Collaborative Charts Strategy Focused on Connection, Growth and Industry Resilience in 2026

eNewsChannels NEWS: -- As lenders continue to navigate a shifting housing market marked by volatility, margin pressure and rapid technological change, The Mortgage Collaborative (TMC) is doubling down on what it believes is the industry's greatest strength: connection.

Cloudvirga’s Loan Hub equips loan teams with modern fintech tools for managing pipelines and borrower communication

eNewsChannels NEWS: -- Cloudvirga, a Stewart-owned provider of digital point-of-sale platforms for lenders, today announced the launch of its new Loan Hub for lenders seeking an optimized loan team experience. The Loan Hub gives loan officers, LO assistants and processors a modern, intuitive workspace to manage their pipelines, collaborate with borrowers and complete key tasks without toggling between systems.

Optimal Blue report: October 2025 lock volume holds second-highest level in three years

eNewsChannels NEWS: -- Optimal Blue today released its October 2025 Market Advantage mortgage data report, showing that rate-lock activity remained strong despite seasonal cooling and continued to outpace last year's levels. Total lock volume fell 4.2% month over month (MoM) from September's peak but was still up 18% year over year (YoY) as borrowers responded to improving affordability and narrower rate spreads.

Dan Jones, MMI’s Chief Technology Officer, Named a 2025 HousingWire Tech Trendsetter

eNewsChannels NEWS: -- HousingWire has recognized Dan Jones, Chief Technology Officer at Mobility Market Intelligence (MMI), as one of its 2025 Tech Trendsetters - an annual honor celebrating 75 technology leaders who are shaping the future of housing through innovation.

LenderLogix AI Sidekick delivers instant insights to improve loan accuracy and reduce loan processing times by up to 40%

eNewsChannels NEWS: -- LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced it has launched AI Sidekick, an artificial intelligence (AI) feature built into the LiteSpeed point-of-sale (POS) platform. AI Sidekick supports loan officers (LOs) with simple tools to instantly review loan files, efficiently update document needs lists and rapidly identify missing data, reducing loan processing times by up to 40%.

Fintech innovator, Friday Harbor adds appraisal underwriting to its AI Originator Assistant

eNewsChannels NEWS: -- Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, today announced that its AI Originator Assistant now performs collateral analysis alongside credit, income and asset reviews. The enhancement enables lenders to underwrite appraisals and appraisal-related documents with the same precision and consistency the platform already delivers for other loan file components.