Tag: Taxes and Accounting

iFOS Managing Consultants Awarded FOIA Support Services Contract with DOD

eNewsChannels NEWS: -- Intelligent Fiscal Optimal Solutions(R) (iFOS) Managing Consultants, LLC is pleased to announce the notification of a multi-year award to provide Freedom of Information Act (FOIA) services for the Office of the Assistant Secretary of Defense for Public Affairs located in Washington, D.C.

Advalent Launches Network 360 Platform to Drive Provider Performance in Value-Based Care Contracting

eNewsChannels NEWS: -- Advalent, a market-leading healthcare technology company focusing on payer solutions announced today the launch of a new network contracting and analytics product - Network 360(TM). Designed for payers and risk bearing healthcare providers, Network 360 is a breakthrough analytics platform that analyzes network, enables value-based contracting, and manages both upside and downside risk.

Tax Resolution Expert Program: PitBullTax Institute Organizes Its Second User Conference

eNewsChannels NEWS: -- PitBullTax Institute, an educational branch of the well-established IRS Tax Resolution Software, organizes its Second PitBullTax User Conference: "Tax Resolution Expert Program." It will take place on September 20-21-22, 2018 at the Hilton Fort Lauderdale Beach Resort. This conference is designed exclusively for existing and potential users of PitBullTax Software.

Medical Practice Consulting Services (MPCS) Expands its Medical Billing Operations in North Carolina

eNewsChannels NEWS: -- Medical Practice Consulting Services (MPCS), a leading national group of practice growth consultants offering revenue cycle management services today announce the strategic expansion and opening of their billing operations, with offices at 2000 New River Inlet, Suite 1001.

Chartered Retirement Planning Counselor Rodger Alan Friedman shares how to engage your grown kids about retirement prep

eNewsChannels NEWS: -- In his compact new book, "Parent's Guide to Your Child's Retirement: 21 Thought-Provoking Conversations to Have with Your Adult Children" (ISBN: 978-0999641415) Chartered Retirement Planning Counselor(SM) Rodger Alan Friedman, delivers an easy to follow structure that may serve to enable you and your grown children to have positive, engaging and thoughtful conversations regarding their future retirement.

Express Information Systems Named to 2018 Accounting Today VAR 100

eNewsChannels NEWS: -- For the second consecutive year, Express Information Systems, a leading provider of business software and consulting for growing businesses in Texas and beyond, has been included in the Accounting Today VAR 100.

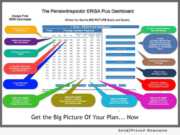

The Pension Inspector Launches ERISA Plus Dashboard, a New SaaS Integrating Prior and Present Form 5500 Filings

eNewsChannels NEWS: -- National Retirement Programs, Inc. and its wholly owned subsidiary AtPrime Media Services, the creator of PensionInspector.com, introduces "Form 5500 Prestige Vision," an addition to its, super easy to use, replacement for the U.S. Department of Labor's ERISA Form 5500 Download Service "ERISA Plus Dashboard."

Express Information Systems Named to Bob Scott 2018 List of Top 100 VARs List

eNewsChannels NEWS: -- Express Information Systems, a leading provider of business software and consulting for growing businesses in Texas and beyond, has announced its inclusion on Bob Scott's Top 100 VARs 2018 published by Progressive Media Group.

Helping Nonprofits Stay Fiscally Smart, Qbix Accounting Solutions Celebrates 10th Anniversary

eNewsChannels NEWS: -- For 10 years, Qbix Accounting Solutions ('Qbix') has provided outsourced accounting and bookkeeping for organizations wanting expert accounting management, oversight, and execution. Qbix was formed in 2008 in Macon, Georgia, just south of Atlanta by Rocky Davidson, CPA.

Tax Resolution Expert Michael Rozbruch Teaches Tax Pros How to Dramatically Boost Their Bottom Line

eNewsChannels NEWS: -- An exclusive, interactive 4-hour live training for CPAs, EAs and attorneys - "The 7-Figure Tax Resolution Practice Blueprint" - is scheduled for June 28. This free training is hosted by tax resolution expert, Michael Rozbruch, founder of Roz Strategies. He'll show tax professionals how to start a tax resolution practice from scratch (like he did) or take an existing practice to the next level.

PitBullTax Software Expands Capabilities with Release of New Version 4.0 for Tax Professionals

eNewsChannels NEWS: -- PitBullTax Software, the leading IRS Tax Resolution Software for CPAs, EAs and Tax Attorneys, just released its new and more feature rich Version 4.0. For nine years PitBullTax Software has transformed the tax resolution business by making it more efficient and intuitive for tax professionals to solve their clients' IRS problems.

New TaxBird Tax App for iOS is Designed for People with Homes in More than One State

eNewsChannels NEWS: -- With this year's tax season in the rear-view mirror, there's no better time to start prepping for the next round. TaxBird - a new tax app developed by ware2now, LLC - helps people with homes in more than one state ensure they don't exceed their residency threshold. It's useful to tax professionals and estate planners too.

PitBullTax University and First PitBullTax Software User Conference Announced

eNewsChannels NEWS: -- PitBullTax, The Leading IRS Tax Resolution Software provider for CPAs, Enrolled Agents and Tax Attorneys received accreditation to be a Continuing Education Provider for tax professionals who are involved in IRS tax resolution and for those who plan to practice in this lucrative specialty. This is yet another milestone in a long history of accomplishments for PitBullTax, and another example of how this company maintains its dominant position in the tax resolution arena.

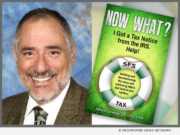

Now available – eBook and Kindle Edition of ‘Now What? I Got a Tax Notice from the IRS. Help!’ by Jeffrey...

eNewsChannels NEWS: -- SFS Tax Problem Solutions Press announces the release of the eBook and Kindle Edition of "Now What? I Got a Tax Notice from the IRS. Help!" (B079XWL8P9) by Jeffrey Schneider. "Now What?" is also available in paperback (ISBN: 978-0692997154) and will be published in an audiobook version in June 2018.

New Book ‘Now What? I Got a Tax Notice from the IRS. Help!’ by Jeffrey Schneider released by SFS Tax Problem...

eNewsChannels NEWS: -- SFS Tax Problem Solutions Press announces the release of "Now What? I Got a Tax Notice from the IRS. Help!" (ISBN: 978-0692997154) by Jeffrey Schneider. "Now What?" is available nationwide today in paperback. It will be published in an eBook edition in March and an audio book edition in June 2018. Schneider defines and deconstructs the scary and confusing letters in a fashion that mixes attention to detail with humor and an intricate clarification of what-is-what in the world of the IRS.

Enrolled Agent Jeffrey Schneider says the IRS Lien and Levy Holiday is over starting Feb. 1 2018

eNewsChannels NEWS: -- After a temporary break during the hurricanes and the holidays, the Liens, Levies and Garnishments that were held back by the IRS are starting again and will be en route to your mailbox to those that owe back taxes, says Jeffrey Schneider EA, CTRS, NTPI Fellow, and principal at SFS Tax Problem Solutions.

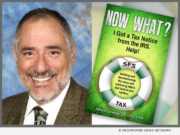

Chartered Retirement Planning Counselor Rodger Friedman Shares How to Avoid Living in Your Kid’s Basement When You Retire

eNewsChannels NEWS: -- In his compact new book, "The Mindset of Retirement Success: 7 Winning Strategies to Change Your Life" (ISBN: 978-0999641408), Chartered Retirement Planning Counselor Rodger Alan Friedman, delivers blunt advice to anyone who has been putting off retirement planning.

Loan Vision joins The Mortgage Collaborative’s Preferred Partner Network

eNewsChannels NEWS: -- The Mortgage Collaborative, the nation's only independent mortgage cooperative, today announced the addition of Loan Vision, a mortgage industry-specific financial management and accounting software provider, to its preferred partner network, giving its Lender Members access to the industry's premier accounting software.

Unalp CPA Group Whitepaper ‘Comparing Xero, QuickBooks, and Sage Intacct’ offered Free to Nonprofit Orgs and Businesses

eNewsChannels NEWS: -- Unalp CPA Group, Inc. announced today the availability of a white paper comparing popular accounting software solutions Xero, QuickBooks, and Sage Intacct. Unalp's document 'Comparing Xero, QuickBooks, and Sage Intacct' covers pricing, ease of use and more than half a dozen functional areas such as reporting, payroll, and invoicing.

Rocky Davidson, CPA, of QBIX is First to Receive AICPA Client Accounting Advisory Services Certification

eNewsChannels NEWS: -- Qbix Accounting Solutions announced today that Rocky Davidson is the first professional to complete and receive certification from the AICPA in Client Accounting Advisory Services. Qbix Accounting Solutions provides client accounting advisory services to nonprofit organizations, often referred to as outsourced accounting services.

New eBook: Optimal Nonprofit Financial Management through Outsourcing, by Rocky Davidson, CPA

eNewsChannels NEWS: -- Qbix Accounting Solutions announces a new eBook by Rocky Davidson, CPA. The 8-page eBook, "Optimal Nonprofit Financial Management through Outsourcing" is written for Nonprofit Executive Directors who are looking to improve their accounting function.

ACS Accounting joins TMC Preferred Partner Network serving Mortgage Lenders

eNewsChannels NEWS: -- The Mortgage Collaborative (TMC), the nation's only independent mortgage cooperative, announced a new partnership with east-coast based CPA and advisory firm, ACS Accounting. The new relationship with ACS, adds another best-in-class tax and accounting firm to their preferred partner network.

Xanegy 2017 Nonprofit Executive Series Fall and Winter Schedule Announced

eNewsChannels NEWS: -- The Nonprofit Executive Series webcasts, hosted by Xanegy, will kick off on Tuesday, September 26, 2017, with "Trends in Human Capital Management." The Nonprofit Executive Series is a monthly webcast for nonprofit leaders.

LeaseAccelerator Webinar: Lease Accounting for Oracle ERP Users, ASC 842 and IFRS 16

eNewsChannels NEWS: -- LeaseAccelerator announced today that it will be hosting an educational webinar on lease accounting for Oracle ERP users seeking to implement a solution for ASC 842 and IFRS 16. The new lease accounting standards, introduced last year, will require companies to track real estate, equipment, and embedded leases as assets and liabilities on their balance sheets by end of 2018.

Jeffrey Unalp, CPA Earns Designation for Completing AICPA NFP Certificate Program

eNewsChannels NEWS: -- Unalp CPA Group, Inc. announced today that founder Jeffrey Unalp, CPA, has earned the AICPA badge for completing the Not-For-Profit (NFP) Certificate Program. Unalp CPA outsourced accounting services provide nonprofit clients with compliance, timely reporting and execution of accounting duties.