Tag: Texas Business

News: FirstClose Unveils XpressEquity with Enhanced Encompass Integration

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced the rebrand of its point-of-sale (POS) experience as XpressEquity, along with a refreshed Encompass® by ICE Mortgage Technology® integration that delivers a streamlined, end-to-end digital workflow for home equity originations.

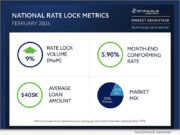

News: Optimal Blue report Spring 2026: Purchase demand rebounds as mortgage market finds balance

eNewsChannels NEWS: -- Optimal Blue today released its February 2026 Market Advantage mortgage data report, showing a meaningful improvement in lock activity as lower mortgage rates helped bring purchase borrowers back into the market. Total rate-lock volume rose 9% month over month (MoM) and was nearly 40% higher year over year (YoY).

Optimal Blue to host 2027 Summit February 1-3, 2027 in Scottsdale AZ

eNewsChannels NEWS: -- Optimal Blue today announced it will host its 2027 Optimal Blue Summit February 1-3 at the JW Marriott Desert Ridge Resort & Spa in Scottsdale, Arizona. The annual event convenes Optimal Blue clients, integration partners and capital markets leaders from across the mortgage industry for three days of insight, collaboration and forward-looking strategy.

Optimal Blue On-demand Virtual Economist anchors nine advancements that unify the capital markets profitability experience across the loan life cycle

eNewsChannels NEWS: -- Optimal Blue today announced Virtual Economist, the first on-demand forecasting tool for mortgage capital markets leaders powered by artificial intelligence and machine learning (AI/ML), as the centerpiece of nine platform advancements unveiled at the company's 2026 Summit. Together, the innovations further unify the capital markets profitability experience by connecting forecasting, pricing, hedging, competitive benchmarking and workflow execution within a single, end-to-end platform.

TruStage and FirstClose form partnership to accelerate dynamic credit union lending documentation

eNewsChannels NEWS: -- FirstClose™, Inc., a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced a strategic partnership with TruStage to embed TruStage's dynamic document engine within the FirstClose platform.

Optimal Blue report Feb. 2026: Sub-6% rates spark refinance surge early in New Year

eNewsChannels NEWS: -- Optimal Blue today released its January 2026 Market Advantage mortgage data report, showing a strong start to the year as falling rates drove a sharp increase in refinance activity. Total rate-lock volume rose 16% month over month (MoM) and finished January 36% higher year over year (YoY), led by a surge in rate-and-term refinances, which climbed 50% from December and more than 400% compared with January 2025.

Stewart-owned NotaryCam surpasses 2 million lifetime notarizations, doubles card transaction volume in 2025

eNewsChannels NEWS: -- NotaryCam®, a Stewart-owned company and leading remote online notarization (RON) provider for real estate and legal transactions, announced a standout year in 2025, having reached more than 2 million successful notarizations to date, including more than 238,000 notarizations completed this year. The company also doubled both its credit card transaction volume and the number of servicers using loss mitigation-related RON transactions through its real estate vertical, exemplifying growing industry adoption of digital solutions.

Scott’s K9’s Real-World Police Experience Drives 4,000+ Elite Protection and Security Dog Placements Worldwide

eNewsChannels NEWS: -- Scott's K9 has reached a significant milestone with over 4,000 dogs trained and placed globally. These protection dogs for sale range from police and government contract placements to private protection dogs. This is an achievement founder, Steve Scott, attributes to a differentiator most protection dog companies lack: authentic police K9 experience applied to family protection.

FirstClose Caps Transformational 2025 With Faster Closings and Platform Expansion

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced 2025 results showing faster closings and measurable efficiency gains as lenders used its technology to meet rising home equity demand in a high-interest-rate environment. The company reduced closing timelines, expanded key integrations and strengthened its operating foundation to support scalable growth in 2026.

Optimal Blue report: December 2025 lock volume closes year on a firm footing

eNewsChannels NEWS: -- Optimal Blue today released its December 2025 Market Advantage mortgage data report, showing that mortgage rate-lock activity ended the year on a firm footing, bucking typical holiday-driven seasonality. Total lock volume rose 2% month over month (MoM) from November and finished 30% higher year over year (YoY), driven primarily by rate-and-term refinances, which climbed 13% from November and more than 170% compared with December 2024.

Austin-based Nyle Maxwell Collision Center Brings on Collision Industry Veteran, Tammie Harper, as Director

eNewsChannels NEWS: -- Nyle Maxwell Collision Center, Austin's highly respected automotive collision repair center located at 13581 Research Blvd., Austin, Texas 78750, has appointed Austin native and collision industry veteran, Tammie Harper, as the company's Collision Center Director, Brent Rayfield, General Manager at Nyle Maxwell Supercenter, has announced.

New guidance from MindBridge Math Mastery highlights how math learning gaps often remain hidden until academic demands increase

eNewsChannels NEWS: -- MindBridge Math Mastery, a U.S.-based educational services organization specializing in conceptual math instruction, is issuing new guidance regarding widespread math learning gaps that allow students to advance academically without developing true understanding. Founded and led by educational clinician Susan Ardila, M.Ed., the organization reports that these gaps frequently remain undetected for years.

FirstClose Integrates Stewart Home Equity Solutions into its OMS, Streamlining Lender Workflows

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, announced today a new partnership with Stewart Lender Services, a division of Stewart Information Services Corporation (NYSE: STC), that enhances FirstClose's Order Management System (OMS) with expanded home equity fulfillment capabilities.

Optimal Blue finance report 2025: Lock volume posts strongest November since 2021

eNewsChannels NEWS: -- Optimal Blue today released its November 2025 Market Advantage mortgage data report, which found that total mortgage rate-lock activity declined with normal late fall seasonality, yet still marked the strongest November in four years. Total lock volume fell 25% month over month (MoM) from October but remained up 17% year over year (YoY), buoyed by historically strong refinance demand and mortgage rates holding near 6%.

Optimal Blue adds Lanny Rogers as chief financial officer and Jeremy Moreno chief revenue officer

eNewsChannels NEWS: -- Optimal Blue today announced the promotion of Lanny Rogers III, CPA, to chief financial officer (CFO) and Jeremy Moreno to chief revenue officer (CRO). Their combined experience and long track records of leadership position the company to advance its next stage of growth and client success with a dedicated financial strategy function and strengthened revenue oversight.

FirstClose appoints Alex Sirpis as VP of Sales

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced the appointment of Alex Sirpis as vice president of sales. In this role, Sirpis will lead the company's sales organization, refine the go-to-market strategy and drive revenue growth as FirstClose continues expanding its presence with mortgage and home equity lenders across the country.

FirstClose Names Adam Nicholson as Director of Professional Services

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced the appointment of Adam Nicholson as director of professional services. Nicholson will lead the company's implementation operations, including project delivery, process optimization and cross-functional coordination to enhance the customer experience.

Lake Michigan Credit Union selects FirstClose Equity Order Management

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, announced today that Lake Michigan Credit Union (LMCU) has implemented FirstClose's Equity Order Management to automate settlement workflows for its home equity lending operations.

Austin-based Velocity Credit Union Introduces ‘Buy Now, Pay Later’ to Give Members Greater Financial Flexibility

eNewsChannels NEWS: -- Velocity Credit Union (Velocity) has announced the launch of a new Buy Now, Pay Later (BNPL) program designed to give members greater financial flexibility and control over their everyday spending. A financial institution with over $1 billion in assets and serving over 80,000 members, Velocity is introducing this program to further its commitment to offering comprehensive financial services to its members for every stage of their life.

Optimal Blue report: October 2025 lock volume holds second-highest level in three years

eNewsChannels NEWS: -- Optimal Blue today released its October 2025 Market Advantage mortgage data report, showing that rate-lock activity remained strong despite seasonal cooling and continued to outpace last year's levels. Total lock volume fell 4.2% month over month (MoM) from September's peak but was still up 18% year over year (YoY) as borrowers responded to improving affordability and narrower rate spreads.

Click n’ Close triples its warehouse line capacity to support growing One-Time Close (OTC) demand

eNewsChannels NEWS: -- Click n' Close, a multi-state mortgage lender, today announced a significant expansion of its warehouse line capacity dedicated to its growing One-Time Close (OTC) construction-to-permanent wholesale lending business. The expansion, supported by Merchants Bank and other warehouse partners, triples Click n' Close's OTC capacity and follows a record fiscal year performance, reinforcing the confidence of its capital partners in the company's financial strength and specialized business model.

FirstClose is celebrating 25 years of mortgage and home equity innovation

eNewsChannels NEWS: -- FirstClose™, a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, is celebrating its 25th anniversary this month. This marks a quarter-century of innovation in modernizing lending processes for residential mortgage and home equity lenders nationwide.

Enterprise Product Manager, NotaryCam, Joseph Bisaillon honored as HousingWire Tech Trendsetter

eNewsChannels NEWS: -- NotaryCam®, a Stewart-owned company and a pioneering provider of remote online notarization (RON) and identity verification/authentication technology for real estate and legal transactions, today announced that Enterprise Product Manager Joseph Bisaillon has been honored as a 2025 HousingWire Tech Trendsetter. The award is given to technology leaders driving impactful innovation in the housing industry.

Chief Product Officer Ramiro Castro of FirstClose named HousingWire 2025 Tech Trendsetter

eNewsChannels NEWS: -- FirstClose™, Inc., a leading fintech provider of data and workflow solutions for mortgage and home equity lenders nationwide, today announced that Chief Product Officer Ramiro Castro has been recognized by HousingWire as a 2025 Tech Trendsetter. The annual award celebrates 75 technology leaders whose vision and execution are reshaping the housing economy.

Benchmark Mortgage names Clay McMurray as Chief Marketing Officer (CMO)

eNewsChannels NEWS: -- Benchmark Mortgage, a full-service mortgage lender and broker based in Dallas, has added mortgage marketing professional Clay McMurray as chief marketing officer. McMurray will help Benchmark Mortgage grow its national brand to new heights, bringing the company's story to life with the goal of helping as many homeowners as possible while attracting top mortgage originators. He brings extensive mortgage industry experience, having led and expanded other national brands.