Strong unit and volume gains across Q1 gave mortgage loan originators their highest commissions payout in the last six months

(MACON, Ga.) — NEWS: LBA Ware(TM), a leading provider of incentive compensation management (ICM) and business intelligence software solutions for the mortgage industry, today released summary statistics on the state of mortgage industry compensation in the first quarter of 2020. The firm’s analysis of data from its CompenSafe(TM) ICM platform shows business grew significantly for lenders across Q1, culminating in March commission payouts that were the highest reported in the last six months.

Methodology

LBA Ware reviewed account data for mortgage lenders that used CompenSafe to automate incentive compensation management throughout the first quarter of 2020. The controlled, sample dataset consisted of retail, first-lien production from LOs who funded at least six loans during the six-month period ending March 31, 2020.

Key Findings

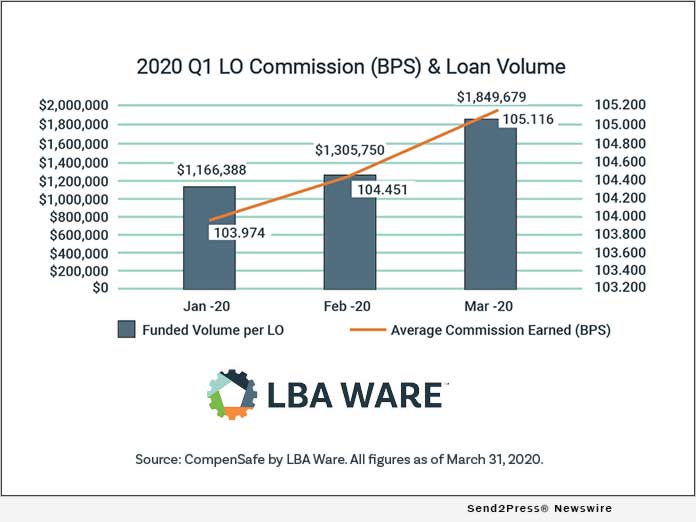

* The total number of loan units funded by the sample group increased by 58.5% from January to March. Over the same time period, total loan volume increased by 66.1%, which translated to an increase in average loan volume per LO from $1.17M in January to $1.85M in March. The portion of funded loan volume attributable to refinances reached 48% in March, an increase of 6% from January.

* Together, these unit and volume gains led to month-over-month increases in loan commissions earned of 14.2% from January to February and 46.9% from February to March.

* Overall, average commissions paid to LOs increased 1.1% from 104.0 basis points in January to 105.1 basis points in March. Broken out by loan purpose, LO commissions on refinances increased 3.1% (from 96.0 basis points in January to 99.0 basis points in March) compared to just 0.9% growth in purchase commissions (from 109.0 basis points in January to 110.1 basis points in March).

* The average March loan amount was $283,900, up from 2019’s average of $259,652, helping LOs reach an average of $18,907 in total commissions for the month.

“Intense market demand for mortgages, including refis, helped loan originators earn average commissions approaching $19,000 in March,” said LBA Ware founder and CEO Lori Brewer. “LOs may want to sock some of that payday away as the industry braces for a protracted economic recession, job losses and stiffer underwriting criteria.”

About LBA Ware

LBA Ware(TM) is a leading provider of cloud-based software for mortgage lenders. Since 2008, LBA Ware has been on a mission to help mortgage companies reach new heights with software that integrates data, incentivizes performance and inspires results. Today, lenders of all sizes, including some of the nation’s top producing mortgage companies, use LBA Ware’s award-winning technology to enhance lender experiences and maximize the human potential within their organizations. A 2019 Inc. 5000 fastest-growing private company, LBA Ware is headquartered in Macon, Georgia. For more information, visit https://www.lbaware.com/.

*IMAGE link for media: https://www.Send2Press.com/300dpi/20-0417s2p-lba-2020-q1lo-300dpi.jpg

Related link: https://go.lbaware.com/

This version of news story was published on and is Copr. © eNewsChannels™ (eNewsChannels.com) – part of the Neotrope® News Network, USA – all rights reserved. Information is believed accurate but is not guaranteed. For questions about the above news, contact the company/org/person noted in the text and NOT this website. Published image may be sourced from third party newswire service and not created by eNewsChannels.com.